[ad_1]

High school students beginning their college search should take a page out of the Boy Scouts’ manual: With the price of a bachelor’s degree topping six-figures, ‘being prepared’ can pay off — literally.

Money’s latest Best Colleges rankings are designed to help you with that preparation. By identifying the schools where students can earn a high-value degree at a comparatively affordable price, our college list can guide you toward a smart financial choice.

But like any college ranking, Money’s list should be used as a starting point. Rankings will never be able to account for the variety of demands individual students will have. That’s why you should pair our rankings with some homework of your own to find your personal “best college.”

As you embark on your college search, keep these four tips in mind:

Don’t get caught up on sticker prices

One of the first things you need to consider when you get serious about your college search is how much you can afford to pay, and relatedly, how much a college will cost.

“You wouldn’t go look at houses to buy without talking about money, and you wouldn’t go buy a car without talking about budget,” says Yvonne Espinoza, who owns her own college counseling business in Austin, Texas.

The same goes for colleges. And when you talk about college prices, you have to remember this cardinal rule: Almost no one pays the sticker price.

At the 671 colleges in Money’s rankings this year, an average 78% of students received grants to reduce the cost of attendance. At some colleges, every student gets a grant. That’s the case at both Indiana-based Wabash College (No. 125) and Pennsylvania’s Juniata College (No. 166), where the typical price after financial aid is more than $35,000 below the schools’ sticker prices.

Money’s rankings consider average net prices — that’s the amount owed after subtracting grants and scholarships. But averages may not be all that helpful to your circumstances, depending on your family’s income and assets, or your academic profile. Instead, use college net price calculators to get a more personal estimate and look up if a college publishes academic cutoffs (like a specific GPA or test score) for its scholarships.

Dig deeper into acceptance rates

The same philosophy applies here, too: average acceptance rates can only tell you so much about your individual chances of acceptance.

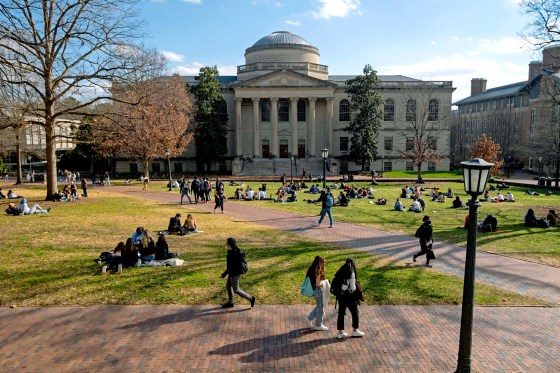

At the University of North Carolina-Chapel Hill (No. 2 in Money’s rankings), the overall acceptance rate last fall was about 19%. But that represents a 42% rate for in-state applicants and a 10.5% rate for out-of-state applicants.

If you’re applying in the early decision round, your odds of acceptance will typically be higher, and the reverse is true if you are applying in the regular admissions pool to a college that had a large early decision cohort that year.

At Wellesley College in Massachusetts (No. 23), for example, a quarter of the incoming freshman class last fall was filled via early decision, an admissions policy where students apply by an early date and promise to enroll if they’re accepted. Early decision applicants at Wellesley had an acceptance rate of 40%. But regular decision applicants, who were part of a much bigger pool, had an acceptance rate of about 13.5%.

Majors can sometimes play a big role, too, particularly if you’re interested in studying business, science or engineering. Take Carnegie Mellon (No. 35 on our selective colleges list). The Pittsburgh-based university is known for its outstanding computer science program, and the acceptance rate into the School of Computer Science is just 7%. That’s compared to a 23% acceptance rate for Tepper School of Business.

Even if a college doesn’t have a lower acceptance rate for a specific college or major, the average GPA or test scores of students getting into that program may still be higher than that for the general student body.

All of this means that to get an informed read on your own chances, you may have to dig into the overall acceptance rate to find the rate that best applies to your application.

College Transitions, a consulting company that advises families on their search, breaks down many of these different acceptance rates on its college pages. But few colleges are as transparent as Carnegie Mellon when it comes to releasing data by major, says CEO Andrew Belasco. For that, your best bet may be contacting a college’s admissions office and asking them whether particular schools or majors are more challenging to get into.

Ask about opportunities for career preparation

A decade ago, most college shoppers were focused on inputs, says Belasco, who is also co-author of the guidebook Colleges Worth Your Money. That is, families primarily wanted to know what type of students a college admitted, including the average test scores or GPAs.

“Now we’re seeing the majority of families also asking about outputs,” he says. “You know, what can a college do for me?”

That’s a smart philosophy. Statistics like average alumni salaries and job placement rates (both of which Money considers in our college rankings) are helpful here. But that’s just scratching the surface. You should also look for where graduates are getting hired, or where they’re enrolling in graduate school, if that’s your plan.

David Ong, president of the National Association of Colleges and Employers (NACE), recommends asking what percentage of students are taking paid internships. Here’s why that matters: Research from NACE finds that, yes, students who have internship experience get more job offers. But paid interns, in particular, do the best. They received 32% more job offers than unpaid interns.

Some colleges, like the University of Richmond (No. 137) or Hobart William Smith Colleges (No. 337), even guarantee students funding to ensure they can participate in an internship or research opportunity.

Larger universities may not be able to promise that to every student, but some still try to even the playing field of who can afford to take unpaid or low-paying internships. The SuccessWorks Internship Fund at the University of Wisconsin-Madison (No. 17), for example, fundraises every year to pay out more than $100,000 in internship stipends.

Access to these hands-on, professional experiences is crucial because good grades alone won’t signal to a hiring company that you’ll be a good addition to its team.

“Skills are much more predictive at the end of the day than anything else you’re going to see on a resume or LinkedIn profile,” says Ong, who’s also the vice president of talent acquisition at Maximus, which provides services for managing government programs. GPA, for example, is one thing employers are screening for far less than they were just three or four years ago, he adds.

Try to picture yourself on campus

Statistics can tell you a lot, but they can’t give you a full picture of a college. One of the best ways to fill in those holes and get an idea of what your experience on campus might look like is to talk with current students, says Sara Zessar, who founded Discovery College Consulting. Some colleges have an official program to connect prospective applicants with student ambassadors, but you could also seek out a student who is majoring in what you’re interested in on your own.

“Getting that student perspective is just invaluable,” she says.

Zessar also recommends looking up the courses that are required in the majors that you think you’ll be interested in to see if they actually sound interesting. And if you’re taking a campus tour, see if you can sit in on one of those classes.

The goal of all this research is to narrow down your college list to a group of schools that you know will be a good fit, both financially and academically.

“Make sure that ‘yes, every school I’m applying to is a place I would be thrilled to go to,’” Zessar says.

Sarah Hansen contributed to this story.

More from Money:

These Are the 25 Best Colleges in America

No SAT, No Problem? How Test-Optional Policies Are Changing College Admissions

Interest Rates on Federal Student Loans Set to Rise This Year

© Copyright 2021 Ad Practitioners, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link